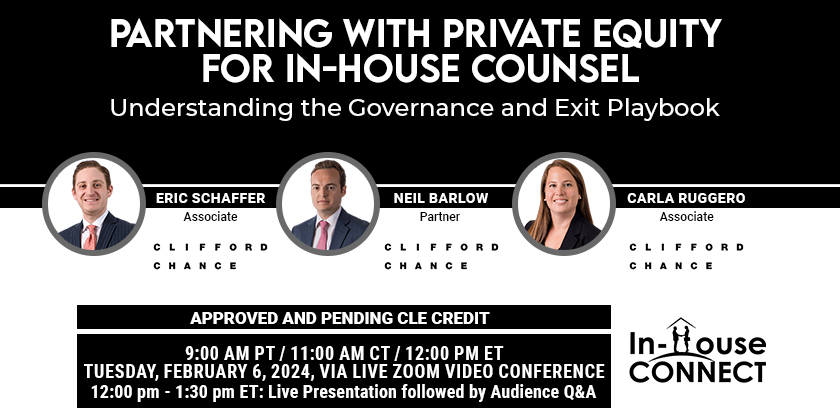

PARTNERING WITH PRIVATE EQUITY FOR IN-HOUSE COUNSEL

Understanding Continuing Legal Education for In-House Counsel In-house counsel play a pivotal role in navigating the legal complexities within corporations. Staying on top of the…

In a recent In-House Connect webinar, “Ethics for In-House Counsel,” special guest Lisa Lang, Vice President and General Counsel for Ohio Northern University and author…

In the recent webinar titled “Navigating US AI Regulation and Government Policy for In-House Counsel,” experts Matthew Ferraro, the Senior Counsel for Cybersecurity and Emerging…

It’s a fact that most attorneys encounter settlement agreements in their professional careers. This Article provides a comprehensive checklist for crafting effective settlement agreements and…

The transition from a law firm to an in-house legal position is a significant career move for many lawyers. This blog post explores key indicators…