-

Speaker Bio

- Sponsored by:

- CLE Details

Thomas G. Zentner

Thoman is the Managing Partner of the Austin office and has an extensive corporate practice, advising on capital markets transactions, including initial public offerings and other equity and debt offerings, and merger and acquisition transactions.

Thomas has developed a robust practice representing private equity backed companies seeking an exit either through the public markets or through complex sale transactions. Additionally, Thomas has considerable experience in assisting public companies in connection with capital markets and merger and acquisition transactions. He has particular experience with clients engaged in the energy and energy transition industries, including oil and gas exploration and production, midstream, oilfield service and renewables companies.

Milam Foster Newby

Milam Newby is the Head of the firm’s Technology practice where he advises on and leads transactions in an array of industries, including technology, financial services, manufacturing, life sciences, chemicals, transportation and energy.

Over the last decade, Milam has developed a particular emphasis on representing investors and startups in private financing transactions. He advises venture capital firms and private equity funds of all sizes, from small, nascent funds to large investment pools managed by preeminent firms. Milam also guides emerging companies from early stage financing to lucrative exits through mergers and acquisitions or public offerings. His other transactional experience includes management buyouts, debt financing, joint ventures and strategic alliances, among other business transactional matters.

Michael Gibson

Michael advises clients on strategic and capital-raising transactions across a broad range of industries, including technology, renewable and sustainable energy, transportation and manufacturing. Michael has extensive experience with minority and growth equity investments (including preferred equity and convertible debt financings), as well as acquisitions, dispositions and sale-of-the-company transactions, and corporate reorganizations. He also regularly advises on corporate governance, securities law and other general corporate matters.

Michael represents a wide variety of enterprises, from public and private companies and their boards of directors, to private equity investors and their portfolio companies, and venture capital investors and emerging growth companies.

Benjamin Heriaud

Ben advises corporate, private equity sponsor and investment banking clients in corporate transactions and governance matters. He specializes in capital-raising transactions, with a focus on initial public offerings, alternative, hybrid and private capital transactions, acquisition financings and high-yield debt offerings.

Ben also regularly counsels sponsors, boards of directors and management teams in mergers and acquisitions and other strategic transactions and disclosure, corporate governance and compliance matters.

Ben covers a variety of industries, with particular experience in technology and industrials.

Ross Cooper

Director, Investment Banking at Bank of America

Eli Gordon

Equity Capital Markets Vice President at BofA Securities

Texas CLE Only

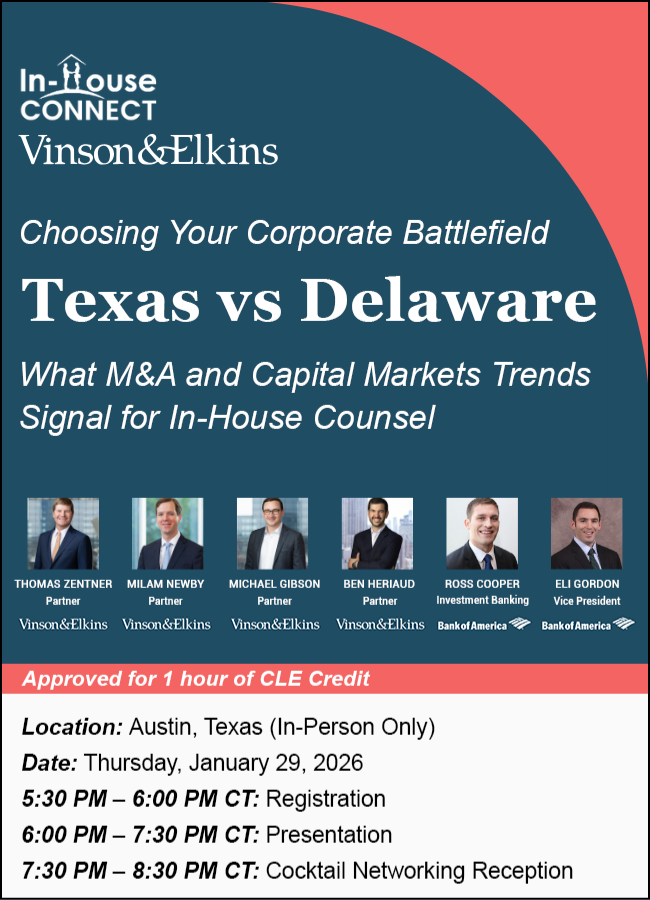

Texas vs. Delaware Strategy: Choosing Your Corporate Battlefield; What M&A and Capital Markets Trends Signal for In-House Counsel

Event Description

As Texas continues to attract high-growth companies and institutional capital, in-house counsel are increasingly asked to evaluate whether Texas or Delaware offers the stronger strategic footing for governance, fundraising, and exit planning. Entity choice shapes valuation dynamics, litigation risk, board decision-making, and deal certainty—yet these decisions now play out against rapidly shifting M&A and capital markets conditions. This Austin-focused CLE demystifies the real-world tradeoffs legal leaders must weigh as they guide founders, executives, and investors through today’s environment.

Join us in person on Thursday, January 29, 2026, as Thomas Zentner, Milam Newby, Michael Gibson, Ben Heriaud, Ross Cooper and Eli Gordon unpack the governance, fiduciary, and dispute-resolution differences between Texas and Delaware entities—then connect those legal distinctions to current dealmaking trends. They will walk through how forum selection can influence transaction speed, negotiating leverage, cost, and exit optionality, and how today’s shifts in buyer behavior, financing availability, and secondary liquidity directly impact entity strategy. Attendees will leave with a decision framework tailored to the pressures in-house teams face when advising on corporate structure in a volatile market.

Key Takeaways:

• How Texas and Delaware differ on governance, fiduciary duties, and litigation exposure—and what those differences mean in practice

• The impact of forum selection on transaction speed, certainty, and negotiation dynamics in M&A and capital markets deals

• How current market trends (buyer leverage, financing conditions, secondary liquidity) influence optimal entity choice

• A practical decision framework to help in-house counsel guide founders, boards, and investors through state-of-incorporation strategy

• Red flags, efficiencies, and optionality considerations when preparing for fundraising or exit in 2026

Who Should Attend:

This session is designed for in-house counsel advising on corporate governance, entity structure, fundraising, or M&A strategy—particularly those supporting high-growth companies, emerging businesses, or investor-backed enterprises deciding whether Texas or Delaware best aligns with their long-term goals.

There is NO COST to attend this program!

This program is FREE, thanks to our gracious sponsor, Vinson & Elkins!