Understanding Continuing Legal Education for In-House Counsel

In-house counsel play a pivotal role in navigating the legal complexities within corporations. Staying on top of the ever-evolving legal landscape is essential to excel in this role. This is where Continuing Legal Education (CLE) becomes invaluable. For in-house counsel, CLE programs offer insights and updates crucial for providing effective legal guidance within a corporate environment.

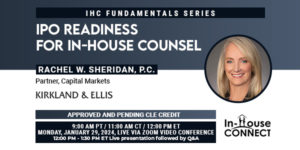

Providers like In-House Connect and In-House Connect On-Demand offer a range of online courses that are tailored to meet CLE requirements, providing a flexible and efficient way to fulfill your obligations.

Tax Deductions for Professional Development

The realm of professional development, including education that keeps you adept in your field, often comes with the benefit of tax deductions. This raises a pertinent question for in-house counsel: are your CLE expenses tax-deductible?

CLE Expenses and Tax Deductibility for In-House Counsel

According to IRS guidelines, educational expenses that maintain or improve skills in your current profession can be tax-deductible. For in-house counsel, CLE courses that enhance your legal expertise within your corporate role typically meet this criterion.

Criteria for Tax-Deductible CLE Expenses

In-house counsel can ensure their CLE expenses are tax-deductible by meeting the following criteria:

- Relevance to Current Role: The CLE course should be pertinent to your role as in-house counsel.

- Exclusion of Career Advancement: The course should not be intended to qualify you for a new profession.

- Compliance with Legal Standards: The course must be necessary for meeting bar requirements or maintaining legal competencies in your jurisdiction.

Claiming Tax Deductions for CLE

To claim your CLE tax deductions, in-house counsel should:

- Maintain Accurate Records: Keep all receipts and documentation related to CLE courses.

- Use Schedule A for Itemization: Deduct your CLE expenses on Schedule A (Form 1040).

- Seek Professional Advice: Given the complexities of tax laws, consulting a tax expert is recommended for tailored guidance.

Case Studies and Notable Resources

An excellent resource for in-house counsel is In-House Connect’s On-Demand library. This platform offers a range of CLE courses tailored to the unique needs of corporate legal departments. These courses are relevant and meet the criteria for tax-deductible professional education.

Conclusion

For in-house counsel, investing in CLE is not just about staying competent; it’s also a financially savvy decision due to potential tax deductions. However, it’s important to ensure that these expenses align with IRS criteria.

If you’re looking to fulfill your CLE requirements conveniently and effectively, check out In-House Connect and In-House Connect On-Demand.