In the complex landscape of labor and employment law, accurately classifying employees is essential to ensure compliance and avoid legal pitfalls. This blog explores the crucial distinctions between exempt and non-exempt employee classifications, details the regulations around deductions for salaried, non-exempt employees, and provides guidelines for identifying and managing independent contractor status.

Exempt vs. Non-Exempt Employees: Key Differences

Employee classification under the Fair Labor Standards Act (FLSA) determines whether an employee is exempt or non-exempt from overtime pay.

Here’s what you need to know:

- Exempt Employees

- Criteria for Exemption

Generally includes executive, administrative, and professional employees who meet specific salary and job duties criteria.

- Salary Basis

Must receive a fixed salary of at least $684 per week, according to federal law.

- Overtime Eligibility

Exempt employees are not entitled to overtime pay, regardless of hours worked beyond the standard 40-hour workweek.

- Non-Exempt Employees

- Overtime Pay

Eligible for overtime at 1.5 times their regular rate for hours worked over 40 in a week. State laws might impose additional requirements.

- Hourly or Salaried

Can be paid on an hourly or salary basis, but must comply with minimum wage and overtime laws.

Deductions for Salaried, Non-Exempt Employees

For salaried, non-exempt employees, handling deductions when they do not meet full-time hours involves several considerations:

- Permissible Deductions

Employers can deduct pay for hours not worked, as long as the salary remains above the minimum wage threshold.

- State Regulations

Compliance with state-specific labor laws is crucial, as some states have stricter rules regarding deductions.

- Policy Communication

Clearly communicate deduction policies to employees to ensure transparency and avoid disputes.

Independent Contractor Status: Criteria and Changes

Determining whether a worker should be classified as an independent contractor involves understanding their working relationship and operational control:

- Independent Contractor Criteria

- Autonomy

Independent contractors typically have significant control over how and when they complete their work, use their own tools, and operate independently from the hiring organization.

- Written Agreements

A comprehensive written agreement outlining the nature of the relationship is vital, especially for compliance and audits.

When Status Might Change

- Integration

If an independent contractor’s role becomes integral to the business or closely resembles that of regular employees, reclassification may be necessary.

- Control and Dependency

Increased control over the contractor’s work and economic dependence on the hiring entity may warrant reclassification.

Regular consultation with legal counsel is essential to ensure correct classification and avoid significant liabilities, such as back wages, tax penalties, and potential litigation.

Properly classifying employees and independent contractors is crucial for maintaining legal compliance and protecting your business. Always seek expert legal advice to stay updated with current regulations and safeguard your organization against potential issues.

Read our latest blog “Labor & Employment Law for In-House Counsel: Top 10 Wage & Hour Mistakes for Employers” to learn more about the common mistakes of employers.

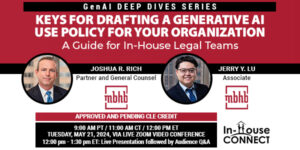

Missed The Session? You can watch it now via IHC On-Demand!